News Category: Estate Planning

2024 Estate Planning Opportunities

The start of a new year is a great time to review your current estate plan or consider creating one. 2024 brings a number of opportunities for creating an estate plan, pursuing gifting strategies, and considering philanthropic goals. Here are a few estate planning opportunities for your consideration this year: Increased Estate, Gift, and Generation-Skipping

Estate Planning – Do I Need a Revocable Living Trust?

One of the most common questions we hear from our clients is “do I need a revocable living trust?” While in some states a revocable living trust is a vital component of any estate plan due to those state’s probate laws, Washington has very friendly probate laws and a revocable living trust is generally not

Back to School – Estate Planning for College Students

As college students prepare to move into campus housing and attend orientation, estate planning is likely the last thing on their mind. However, when a person turns 18, health care decisions and managing financial matters no longer reside with the parent. Having certain estate planning documents in place prior to the start of the school

Did You Buy Marriage Insurance? The Importance of Prenuptial Agreements in Community Property States

Around the world there are millions of people who rely on insurance for homes and vehicles to celebrity body parts. Nowadays, there is even insurance to cover the postponement or cancellation of one’s wedding. Ironically, the average couple prefers to forgo the “marriage insurance” a proper prenuptial agreement can provide because of the stigma associated

When Do I Need an Estate Plan?

One of the most common questions we receive in our Estate Planning practice is “when do I need a personalized estate plan?” While there are many factors to consider, you will want a personalized estate plan when there is a significant change in your life, or you do not like the default plan created for

Remember the Remainderman: Rights and Responsibilities of a “Life Tenant” in Washington State

In the State of Washington, a life estate is a legal arrangement where a person, known as the “life tenant,” has the right to use and occupy a property for the duration of his or her life. The life tenant has all the same rights and responsibilities as a regular owner, but only for the

Estate Planning 101: Making Bequests to Charity

Many clients opt to make charitable donations to further charitable intentions and to perhaps help reduce estate tax exposure in the process. Charities often fulfill needs and perform work that the government does not otherwise provide, and supporting a charity can stretch one’s dollars further as charities can be more efficient with the contributions than

What to Know if You’re Getting Divorced and Your Spouse Holds Power of Attorney

Worried about a financial power grab in divorce? A power of attorney can be like writing a blank check to your spouse. Many married couples will sign powers of attorney as part of their estate planning documents, which provide broad authority to act on the other spouse’s behalf. Estranged spouses have used powers of attorney

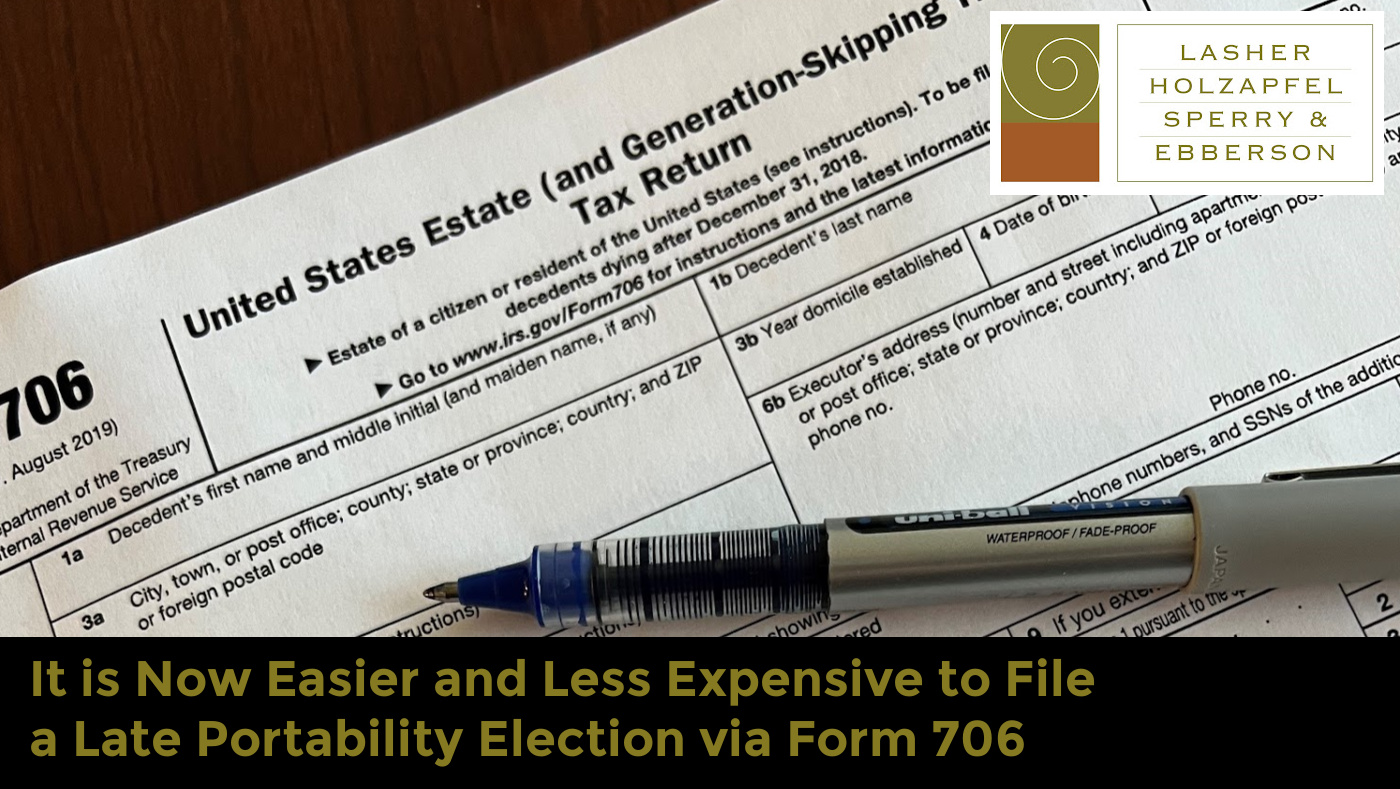

It is Now Easier and Less Expensive to File a Late Portability Election via Form 706

On July 8, 2022, the IRS issued Rev. Proc. 2022-32 that simplified the method for obtaining late relief for failure to timely make an estate tax portability election and extending the time for filing portability returns from two years after the death of the first-to-die spouse to five years. A portability election allows the surviving

When Animals Are More Than a Pet: Differences in Rights and Responsibilities for Service and Emotional Support Animals

What is the difference between a service animal and an emotional support animal? A service animal is a dog which has been trained to perform a specific task or to do work directly related to a person’s disability. Service animals perform a wide variety of vital services such as allergen alerts, seizure response, and hearing